In H1 2024, the M&A activity in the Cybersecurity, CloudTech & DevOps, EdTech and HR Tech sectors showed mixed performance, influenced by macroeconomic factors and geopolitical uncertainties.

July 2024, London

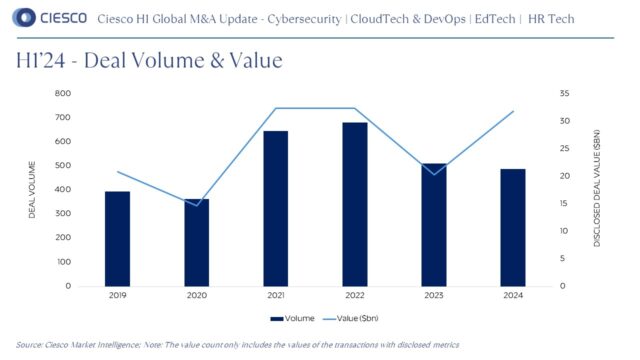

- Deal value reported in H1 2024 is up 57% compared to H1 2023.

- Three deals worth over $5bn occurred between April and June: Darktrace was acquired by Thoma Bravo for $5.3bn (39.6x EV/EBITDA), PowerSchool Group was acquired by Bain Capital for $5.6bn (32.8x EV/EBITDA), and HashiCorp was acquired by IBM for $6.4bn.

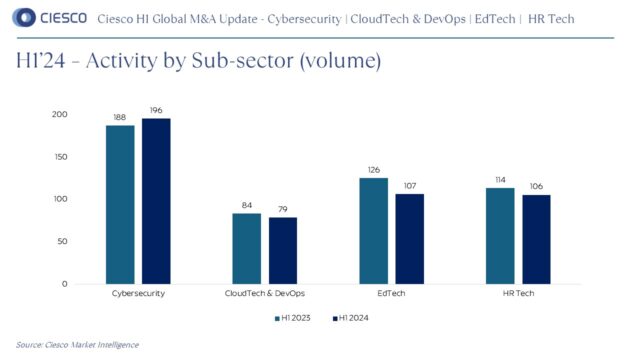

- Cybersecurity remains a critical area, with a 4% increase in the number of transactions in H1 2024 compared to H1 2023. This uptick highlights sustained investment in cybersecurity, driven by the persistent need to address growing digital threats and the rising importance of securing digital infrastructures.

- The HR Tech, EdTech, and DevOps sectors saw a 7% decline in the volume of transactions compared to H1 2023. This slight decline was not surprising, following the sizeable pandemic bump in 2022 and 2023.

- The USA and the UK continue to be the most active M&A markets in H1 2024, representing 51% of all global deals within the Tech sector.

Global Volume & Value

In total, 488 deals were completed in the tracked technology subsectors in H1 2024, reflecting the varied performance across the different subsectors. This represents a 7% decrease from H1 2023, highlighting the challenges and shifts within the industry.

Sector activity:

The technology sector continues to evolve rapidly, with several pivotal trends shaping its future:

- Cybersecurity: Investment in cybersecurity is on the rise, driven by the increased adoption of cloud services and the widespread shift to remote work. Additionally, advancements in artificial intelligence introduce new security challenges, necessitating robust protective measures.

- EdTech: The EdTech industry is experiencing significant growth, with AI playing a crucial role in personalizing learning experiences. Cloud platforms facilitate remote and hybrid learning, enhancing accessibility and flexibility for students and educators alike.

- CloudTech & DevOps: Expenditures on cloud computing are expected to surge, fuelled by the demand for scalable and flexible IT infrastructure. This trend is driven by the need for businesses to maintain agility and efficiency in a dynamic market environment.

- HR Tech: AI is revolutionizing HR processes, from recruitment to talent management, by enhancing efficiency and improving the overall employee experience. It also streamlines performance evaluations, making them more accurate and insightful.

- AI: Artificial intelligence is a catalyst for innovation and efficiency across various sectors. Companies are increasingly investing in AI technologies to optimize operations and gain a competitive edge in the marketplace.

These trends highlight the ongoing digital transformation and the increasing reliance on advanced technologies to meet evolving business needs.

Markets

In H1 2024, the USA and the UK remained the most active M&A markets, accounting for 51% of global deals in the focus sector. France, Germany, the Netherlands, Japan, and India followed, together representing 70% of total deal volume. The APAC region is experiencing growth, completing 13 more transactions in H1 2024 compared to H1 2023. This increase is driven by Japan’s activity on the back of low interest rates, a weaker yen, and a recovering stock market.

Despite mixed results and subdued activity in some sectors, the M&A landscape in the technology sector is anticipated to regain momentum in the second half of 2024. Improved financial conditions, potential interest rate cuts, and heightened executive confidence are expected to drive renewed growth and strategic acquisitions.

If you would like to have a discussion about what we are seeing in the market, please do not hesitate to reach out to Ateesh Srivastava, Managing Director Tech & Software at Ciesco, ateesh.srivastava@ciesco.com.

About Ciesco

Ciesco is a leading specialist M&A firm with a focus on the technology, media, healthcare and sustainability sectors. Headquartered in London and operating globally, Ciesco offers a unique combination at partnership level of senior industry practitioners and sector specialist investment bankers. This enables an extensive network of contacts and strong relationships that reach into organisations worldwide at C-suite sponsor levels. Ciesco is well regarded in the market for its specialist advice derived from the deep understanding of the sector, industry and buyer landscape insights, and execution expertise.