2024 Ciesco M&A Review: In-Depth Analysis of Media and Marketing Sectors with Expert Guest Insights

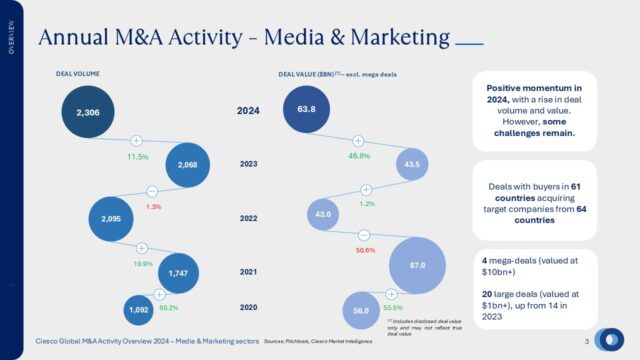

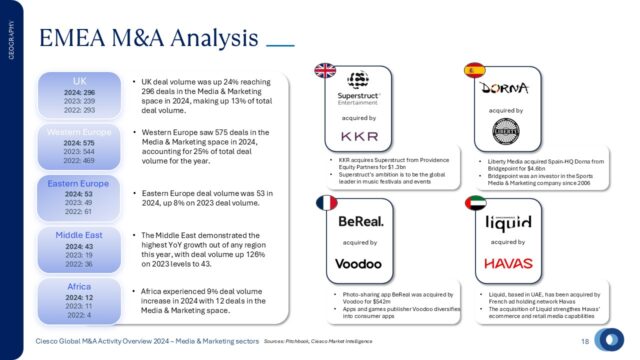

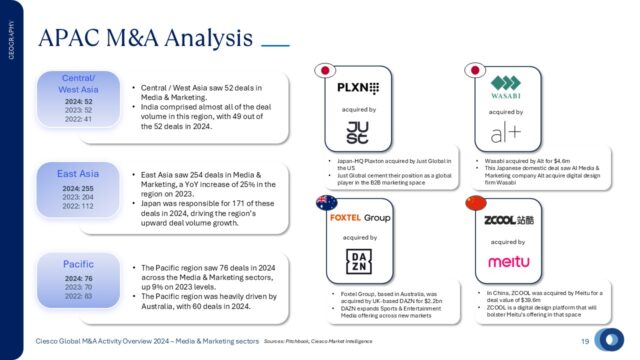

The Ciesco 2024 Annual Media & Marketing M&A Review analyses the trends and activities in M&A within the global media and marketing landscape. In 2024, the sector saw significant signs of bouncing back from the slowdown in 2023. There were 2,306 transactions, marking a 12% increase from 2023. While total deal value (*disclosed) declined 11% to $129.8bn, deal value excluding mega-deals (deal value >$10bn) surged 47% to $63.8bn, reflecting a shift towards mid-market acquisitions and strategic consolidation.

The largest deal in the sector was KKR-backed Skydance Media’s acquisition of Paramount Global, reinforcing the continued importance of scale and content ownership. In total, four mega-deals (deal value >$10bn) closed, in line with 2023, while 20 deals exceeded $1bn.

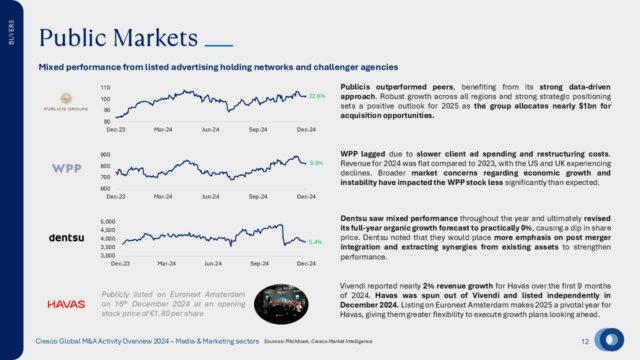

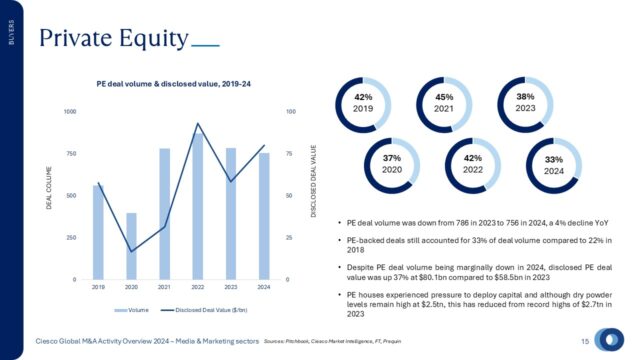

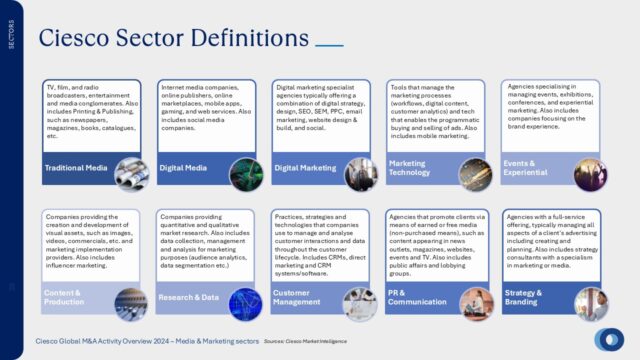

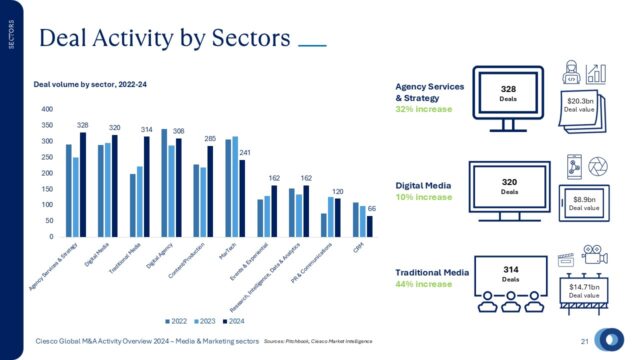

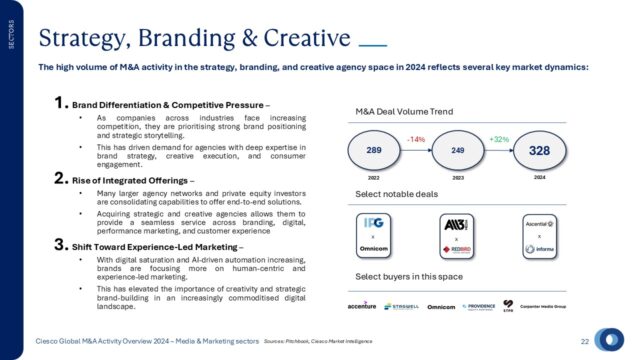

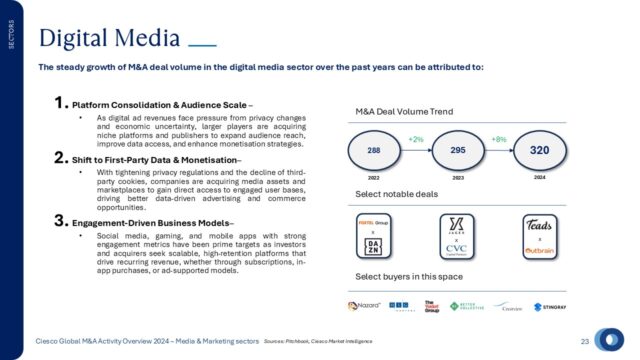

By sector, Agency Services & Strategy saw the highest activity, with +32% increase in activity YoY, followed by Digital Media and a resurgent Traditional Media sector, the fastest-growing segment. Strategic buyers led activity with 1,550 deals (+21% YoY), while Private Equity’s share declined to 33% , reflecting cautious capital deployment amid high interest rates.

Key Macro & Industry Trends

Several macroeconomic forces shaped the M&A landscape:

- High Interest Rates & Capital Deployment: Strategic buyers led activity with 1,550 deals (+21% YoY) as PE’s share declined to 33%, amid cautious capital deployment.

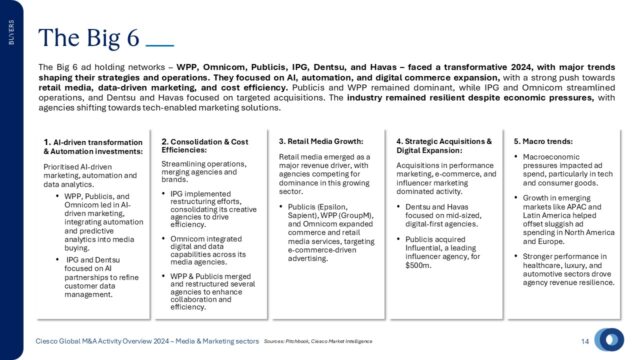

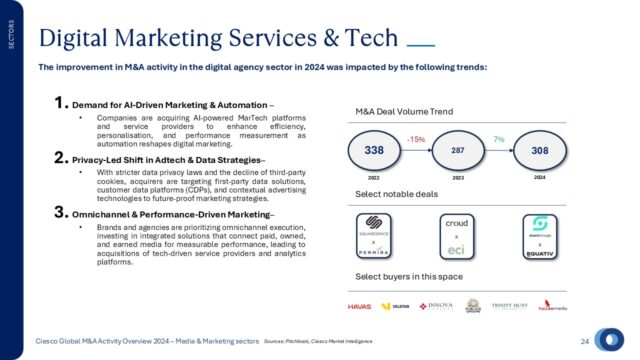

- AI & Automation Driving Investment: The rapid adoption of AI-powered marketing, content automation, and audience analytics fueled acquisitions across AdTech and Digital Media.

- Data Privacy & First-Party Data Strategies: Stricter global regulations accelerated investment in customer data platforms (CDPs) and identity resolution tech.

- Shifts in Consumer & Advertiser Behaviour: Growth in Retail Media, Influencer Marketing, and Connected TV (CTV) reshaped deal activity as advertisers pivoted towards digital-first engagement.

Outlook for 2025

Looking ahead, AI-driven marketing, automation, and digital transformation will remain key M&A drivers, with private equity activity expected to rebound as capital costs ease. Traditional media consolidation will continue while digital-first players scale to capture shifting consumer attention.

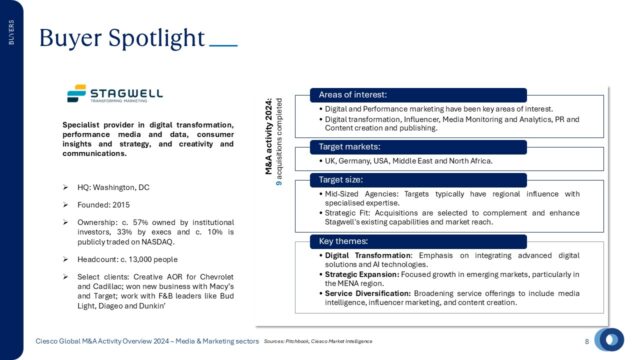

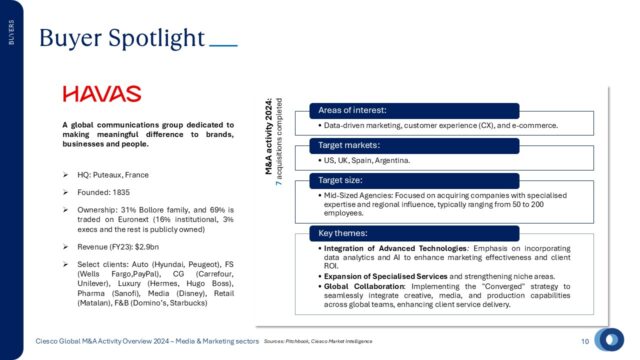

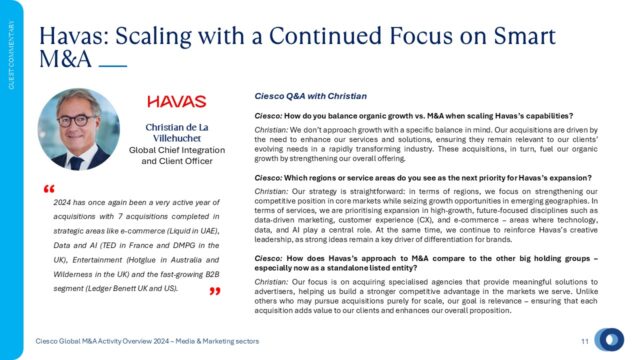

As AI reshapes content creation and media buying, creativity will be the defining competitive edge. The most successful companies will pair AI-driven efficiencies with human-led storytelling, brand strategy, and original content to foster deeper engagement and brand differentiation. At the same time, real-time customer insights are more critical than ever, as businesses seek to enhance personalisation and optimise campaign performance. As Christian de La Villehuchet, Global Chief Integration and Client Officer at Havas, noted in his commentary, agencies are prioritising high-growth, future-focused disciplines like data-driven marketing, customer experience (CX), and e-commerce, where AI and technology play a central role.

Social and influencer marketing continues to attract ad budgets, with brands prioritizing creator-driven content, authentic brand advocacy, and community-led engagement. Live events and experiential marketing are also seeing a resurgence, as brands invest in immersive, in-person experiences to deepen consumer engagement and create meaningful brand interactions.

Meanwhile, purpose and impact are becoming central to investment decisions, as consumers and businesses expect brands to align with sustainability, social responsibility, and ethical business practices.

With strong fundamentals and evolving investment opportunities, the Media & Marketing sector is poised for another dynamic year of transformation.

About Ciesco

Ciesco is a leading specialist M&A firm with a focus on the technology, media, healthcare and sustainability sectors. Headquartered in London and operating globally, Ciesco offers a unique combination at partnership level of senior industry practitioners and sector specialist investment bankers. This enables an extensive network of contacts and strong relationships that reach into organisations worldwide at C-suite sponsor levels. Ciesco is well regarded in the market for its specialist advice derived from the deep understanding of the sector, industry and buyer landscape insights, and execution expertise.