Our annual global M&A review celebrates yet another remarkable year in the industry and provides a thorough analysis and global overview of the trends and highlights in the M&A activity in the sectors.

Global M&A highlights for 2019

Slight decline in M&A activity

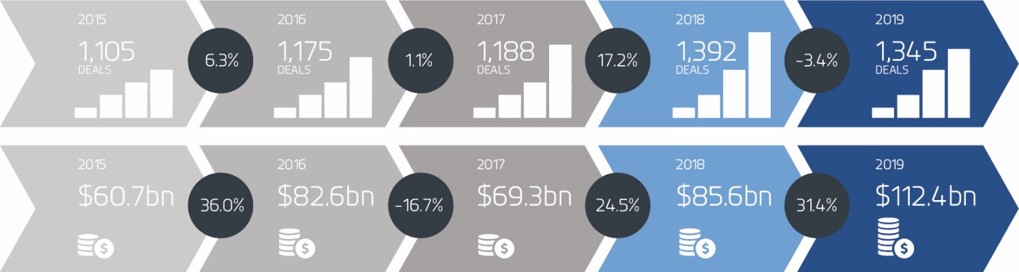

Figure 1: Global M&A Deal Statistics

Overall, deal activity in the digital, media, marketing and related technology sectors saw a slight decline compared to the previous year, with the most remarkable deals including, among others, $12bn merge of CBS with Viacom and the $7.6bn acquisition of Axel Springer by KKR.

A blockbuster year for private equity

The spotlight this year was on Private Equity buyers – they made up 42% of all transactions in the sectors, with KKR being the most active buyer. Following a record-breaking year for fund raising in 2017 & 2018, an accumulation of large pools of capital have been deployed in 2019, resulting in an extraordinary year for Private Equity firms in the sector.

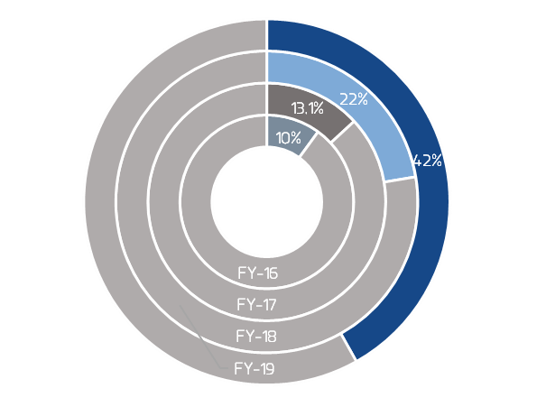

Figure 2: Private equity buyers as a percentage of total deals in the

Digital, Media, Marketing and related-technology sectors 2016-19

We recorded 563 private equity-backed deals in 2019 – 42% of all transactions globally, compared to 22% in 2018. These deals were carried out through a combination of straightforward acquisitions as well as acquisitions by existing portfolio companies, with funds looking to build on their footholds in the sector.

A changing guard – Accenture is the new top acquirer

Our top 10 buyers list again featured a diverse list of large holding networks, consultancies, tech companies, private equity firms, emerging and mid-market groups, reflective of the evolving buyer landscape in the space. Accenture overtook Dentsu (who in the past has been our most prolific acquirer) with 16 acquisitions in 2019.

Accenture has been at the forefront of the trend of consultancies making headwinds in the sector, looking to broaden their service offering, with particular focus on innovation, digital and creative capabilities.

The traditional holding networks still feature in our Top 10 chart, but their deal appetite fell for the thirrd year in a row. Overall, the total M&A activity by the six largest global networks has been falling consecutively for the last three years, to only 2% of global M&A activity in 2019. In 2019 the Big Six (WPP, Omnicom, Publicis Group, Dentsu, and Havas) have, between them, acquired 26 companies – well below the 52 deal count they notched up in 2018. Dentsu only made 13 acquisitions last year, Publicis 5, IPG was the only network which did not engage in any M&A activity in 2019.

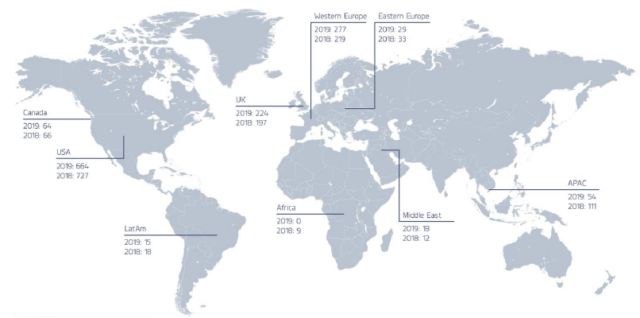

Truly global M&A deal activity

Once again, deal activity across the sector was truly global, with buyers from 48 countries acquiring targets from across 56 countries.

The US again continued to dominate the market despite volatility in the White House and a trade war with China. Deals involving US-based targets made up almost half of overall deal activity. 2019 deal volume stood at 664 deals.

The UK maintained its position as the second largest market, despite the uncertainty surrounding Brexit – it recorded 224 deals, or a 13% increase.

Excluding the UK, Western Europe – increased by 26% with a deal count of 277. Germany appears to be once more at the forefront of the region with 51 deals, close to 2018 levels, whereas France ranks second in Western Europe, reporting 49 transactions. Spain and Netherlands also reported a significant increase in their deal flow.

The APAC region continued to have a subdued year in terms of M&A activity, slipping to 54 transactions in 2019, a 51% drop from 2018. This was driven largely by a 88% decline in the deal volume involving targets in China.

Despite regional disparities, the share of cross-border transactions increased both in volume and as a percentage of total deals (rising from 29% to 38%).

Our outlook for 2020

Ciesco foresees a vigorous M&A market in 2020, fuelled by ground-breaking advances in Artificial Intelligence for as-a-service platforms, adoption of Blockchain by smaller businesses, and further acceleration on the 5G data network.

Also, in-house vs in-agency will remain a pressing issue, fake headlines and pervasive social media will continue to receive special attention, and an increase in digital advertising expenditure as opposed to traditional TV is highly likely.

Macroeconomic factors such as the continuous prominence of China’s economy, the US-Centric approach embraced by the United States, the low interest rate environment and the presumed Ageing Population, are anticipated to further shape the industry in 2020.

Download the report

The full 48-page report includes detailed analysis on:

- Deal statistics, volumes, values

- Notable deals

- Buyer landscape

- Emerging buyers

- Private equity activity

- Geographic overview

- Cross-border activity

- Sectors

- Ciesco’s outlook

The report also features Guest Editorials from Drew Train, CEO and Co-Founder of Oberland, and from Johnathan Barrett, Senior equity research Analyst covering Media, Digital & Innovation at Panmure Gordon & Co