H1 2024 results are in: The M&A activity in tech-enabled media & marketing sectors continues to rise, with a 7% year-on-year improvement in volume, a trend set to accelerate in the second half of the year.

July 2024, London

- The Technology & Media sector saw a rise in activity in the first half of this year, with M&A deal volume increasing by 7% compared to H1 2023 and 9% compared to H1 2022.

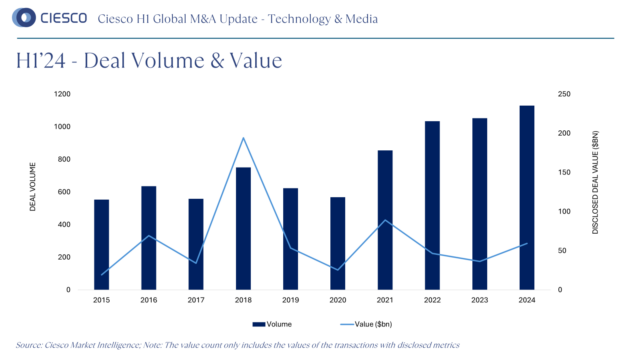

- Deal value reported in H1 2024 is up 63% compared to H1 2023. Two mega deals worth over $10bn occurred in March and April: Endeavor was acquired by Silver Lake in a public-to-private LBO for $13bn, while JBB Advanced Technologies sold a subsidiary of Tronic to Tronic Ventures for $12.25bn.

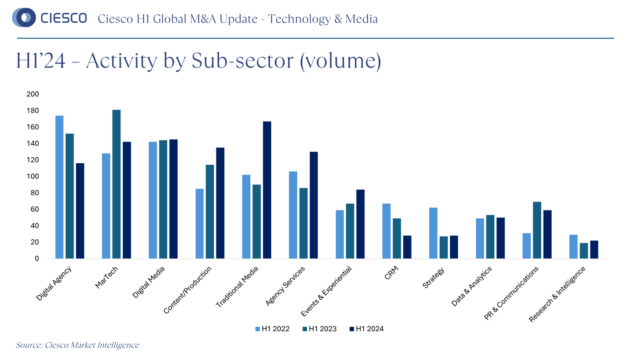

- Traditional Media currently leads the deal count in H1 2024, making it the most active sub-sector. This includes companies across the traditional publishing media sectors, including TV and Print.

- Digital Media, AdTech & MarTech, and Content & Production also attract strong buyer interest.

- The USA and the UK continue to be the most active M&A markets in H1 2024, representing 49% of all global deals within the focus sector. Notably, the Middle East recorded 22 deals in the first half of 2024, surpassing the region’s total deal count for all of 2023.

- Corporate-led (strategic buyer) acquisitions account for the majority of transactions in H1 2024 as PE-backed deals make up 30% of total deal volume. PE buyers’ activity has fallen compared to H1 2023, where they accounted for 42% of total deal volume.

Global Volume & Value

1,129 transactions were announced in the first half of 2024 in the Technology & Media sectors. This was a 7% increase in year-to-date deal activity from the same period in 2023 and a 9% increase in H1 2022. This demonstrates an uptick in M&A deals following somewhat subdued activity in recent years.

Sector activity:

Ciesco Market Intelligence is tracking strong activity across the digitally-led subsectors, including Digital Media, Digital Agency, AdTech/MarTech, CRM and Data & Analytics. The Traditional Media subsector saw the highest increase in buyer interest at >230%, while the Agency Services sector – second highest -at c. 80% growth.

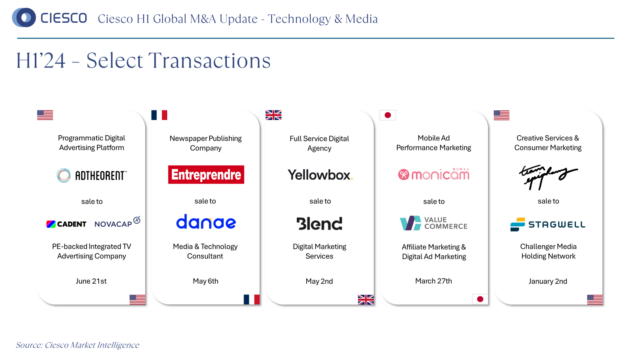

In January, Thomson Reuters announced the acquisition of London-headquartered World Business Media, a subscription-based provider of news and analysis on the insurance and reinsurance market. In May LLCP’s Law Business Research, a technology-driven information services business powering the global legal, intellectual property and governance, risk, and compliance markets, was sold to ICG.

Some of the sector trends we highlight in Tech-enabled Media & Marketing include:

- AI developments and its implications on: a) Enterprise Data b) Content Production and Creative Services c) Forecasting & Budgeting d) Customer Experience.

- Agility: Composable platforms and Low-code capabilities increasingly gaining traction.

- Privacy: ‘The death of the cookie’ and consumer behavioural shifts.

- Marketing effectiveness and the emphasis on brand building and longevity.

- Ecommerce: Retail data continues to grow, as retailers seek ways to monetise the deep customer data they own; a unified commerce strategy by retailers is expected to grow.

- Influencer & Social: At the end of 2023 the global influencer industry was worth c. $21 billion and with such rapid growth there now comes a need for regulation, safeguarding, transparency and accountability.

- Events & Experiential: The spend in this area is booming and we are seeing a strong bounce-back post-Covid 19 hit.

- Sports: User engagement in sports, red-hot space of women’s sports, return of ad budgets into e-sports and the rise of global sports broadcasting.

Markets

The two largest M&A markets remain the USA and the UK, accounting for 49% of total deal volume. They were followed by France, Japan, Germany, Canada and Australia, all of which combined represent 72% of total deal volume. Notably, the Middle East recorded 22 deals in the first half of 2024, surpassing the region’s total deal count for all of 2023. Most of the transactions were cross-border with buyers originating from the USA, UK and India as most active.

Continuing the 2023 trend, APAC’s deal activity is on an upward turn, with 33% more deals completed in H1’24 than in H1’23. There were 88 target companies acquired in Japan, accounting for almost half (43%) of all deals in the APAC region.

We are anticipating these positive trends and dynamics to continue into the second half of 2024 at accelerated pace. Our recent market conversations and activity across M&A and Capital Raising landscape also support our optimism.

If you would like to have a discussion about what we are seeing in the market, please do not hesitate to reach out to Chris Sahota, CEO and Founder at Ciesco, chris.sahota@ciesco.com.

About Ciesco

Ciesco is a leading specialist M&A firm with a focus on the technology, media, healthcare and sustainability sectors. Headquartered in London and operating globally, Ciesco offers a unique combination at partnership level of senior industry practitioners and sector specialist investment bankers. This enables an extensive network of contacts and strong relationships that reach into organisations worldwide at C-suite sponsor levels. Ciesco is well regarded in the market for its specialist advice derived from the deep understanding of the sector, industry and buyer landscape insights, and execution expertise.